If you’ve read articles or social posts saying that if buyers lower their credit score, they can get a better deal on a mortgage, please read on!

It’s just not true!

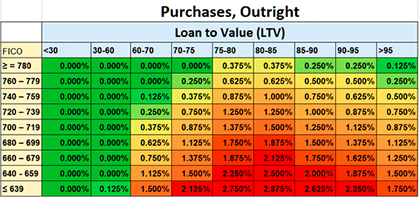

There have been changes to something called Loan Level Price Adjustments, which affect the cost of a mortgage based on things like credit score and how much money you put down.

These changes mean that people with lower credit scores will pay less than they used to, and people with higher credit scores will pay more… than they used to.

There is no scenario where someone with lower credit will have a lower fee than someone with higher credit who puts down the same amount of money.

But even with these changes, people with higher credit scores will still pay less overall because they are less risky for lenders.

This color-coded chart shows the actual cost of fees to borrowers with the new changes implemented.

Some people don’t like these changes, but others think they are dood because they help people who can’t afford big down payments.

THE BOTTOM LINE:

New mortgage rules don’t punish those with good credit to reward people with bad credit It’s important to get the facts and not just believe what you read or hear in the news or on social media!

Please call if you have ANY questions!